Search Blog

Hit enter to search or ESC to close

Trending Now

AirAsia wins Platinum in travel category at Putra Brands Awards

- Get link

- X

- Other Apps

Touch ‘n Go Wins Super Aspiring Brand Award in the Lifestyle Category at the Shopee Super Awards 2023

- Get link

- X

- Other Apps

Showing posts with the label Touch ‘n Go eWallet

Posts

TNG Digital introduces a 1% overseas transaction conversion fee for its cross-border QR payment feature in the TNG eWallet

There will be a nominal 1% overseas transaction conversion fee charged for TNG eWallet’s cross-border QR payment feature. The fee is according to industry standard, and TNG eWallet is confident that still offers one of the best rates in the market. TNG Digital Sdn. Bhd. ('TNG Digital'), Malaysia's largest integrated fintech player, will implement a nominal 1% overseas transaction conversion fee for its cross-border QR payment feature in TNG eWallet, starting April 25, 2024. Over the past year, TNG Digital has subsidised the cost of overseas transactions to promote the use of TNG eWallet for international payments, despite this being a common fee charged by all credit and debit cards, as well as other eWallets. This fee will be reflected in the daily exchange rate of the user's travel destination, which will be shown in real-time before payment. This ensures full transparency and eliminates any separate hidden fees. This fee does not affect the fee structure of the Touch...

- Get link

- X

- Other Apps

Malaysians voted Touch ‘n Go eWallet by TNG Digital as the Brand of the Year

Touch ‘n Go eWallet by TNG Digital was crowned the 2023 Putra Brand of the Year at the 2023 Putra Brand Awards Going from strength to strength – After winning 'Fintech of the Year' at the Fintech Frontiers Awards Malaysia in October 2023, Touch ‘n Go eWallet by TNG Digital Sdn. Bhd. ('TNG Digital') has now been voted the 2023 Putra Brand of the Year at this year’s Putra Brand Awards, also known as 'The People’s Choice Awards' by Malaysians. Established in 2010 by the Association of Accredited Advertising Agents Malaysia (4As) in collaboration with Malaysia’s Most Valuable Brands (MMVB), the Putra Brand Awards is Malaysia's top brand recognition platform. With the award nomination stemming from consumer votes, receiving these awards reaffirms TNG Digital as the leading eWallet provider, recognised by both industry experts and consumers. Alan Ni, Chief Executive Officer of TNG Digital Sdn. Bhd., expressed gratitude for the recognitions given by Malaysians who...

- Get link

- X

- Other Apps

Touch 'n Go eWallet Wins Fintech of the Year 2023, further solidifying position as Malaysia’s leading eWallet

Touch 'n Go eWallet emerged as winner of the 'Fintech of the Year' at the Fintech Frontiers Awards Malaysia that took place October 4, 2023 Further establishing its position as Malaysia’s number one eWallet, Touch ‘n Go eWallet stayed ahead of the competitive landscape by offering users a comprehensive range of payment and financial services, including but not limited to investments, insurances, lending, cross-border payments, remittances, and more. Being the largest eWallet in the market, TNGD continues to champion financial inclusion by making financial services accessible to all and driving convenience via the eWallet. Alan Ni, Chief Executive Officer of TNG Digital Sdn. Bhd., dedicated this momentous win to the team at TNGD and expressed, "This recognition is a testament to our team's dedication and innovation. We thank our valued users who voted for us as their top choice of eWallet in Malaysia. We are grateful for our users’ trust, support, and unwavering con...

- Get link

- X

- Other Apps

Touch ‘n Go eWallet to merchants: status quo on DuitNow QR fees until further notice

TNG Digital Sdn Bhd (“TNGD”) will maintain status quo on DuitNow QR fees until further notice. TNGD is committed in supporting the national digital inclusion agenda and SME businesses with a reliable and cost-efficient digital payment method. With a long-term perspective in mind, reasonable merchant fee is needed to cover costs and investments needed by the industry to upkeep their payment systems which include cybersecurity and fraud prevention controls. For now, no additional fees will be implemented for our merchants until the industry aligns and moves forward together. Alan Ni, Chief Executive Officer of TNG Digital Sdn. Bhd., expresses, “This very much aligns with our commitment as the leading digital wallet provider in Malaysia, in providing convenience through our payment services to small and medium-sized businesses across physical and online infrastructure, all within a safe and secure environment.”

- Get link

- X

- Other Apps

Celebrate Merdeka and Malaysia Day with Up to RM4 Million Worth of Rewards on Touch ‘n Go eWallet

In celebration of Merdeka and Malaysia Day 2023, TNG Digital Sdn. Bhd. (TNG Digital) is offering its over 21 million Touch ‘n Go eWallet users the chance to enjoy over RM4 million worth of rewards with the ‘Hidup Bebas dengan Touch ‘n Go eWallet’ campaign. This includes attractive lifestyle promotions, such as Food, Travel, Entertainment, and more, whereby rewards are in the form of cashback, discounts, cashback vouchers, reload PINs or eWallet credits. Alan Ni, Chief Executive Officer of TNG Digital said, “We want users to pay confidently and enjoy the variety of promotions we have lined up for these two months. At TNG Digital, we strive to create a comprehensive ecosystem that meets the evolving lifestyle needs of our users and we are certain that they will be able to benefit from these promotions and get more value for using Touch ‘n Go eWallet”. From 1st August 2023 until 30th September, users will be able to enjoy a multitude of great deals from convenience stores to utilities fro...

- Get link

- X

- Other Apps

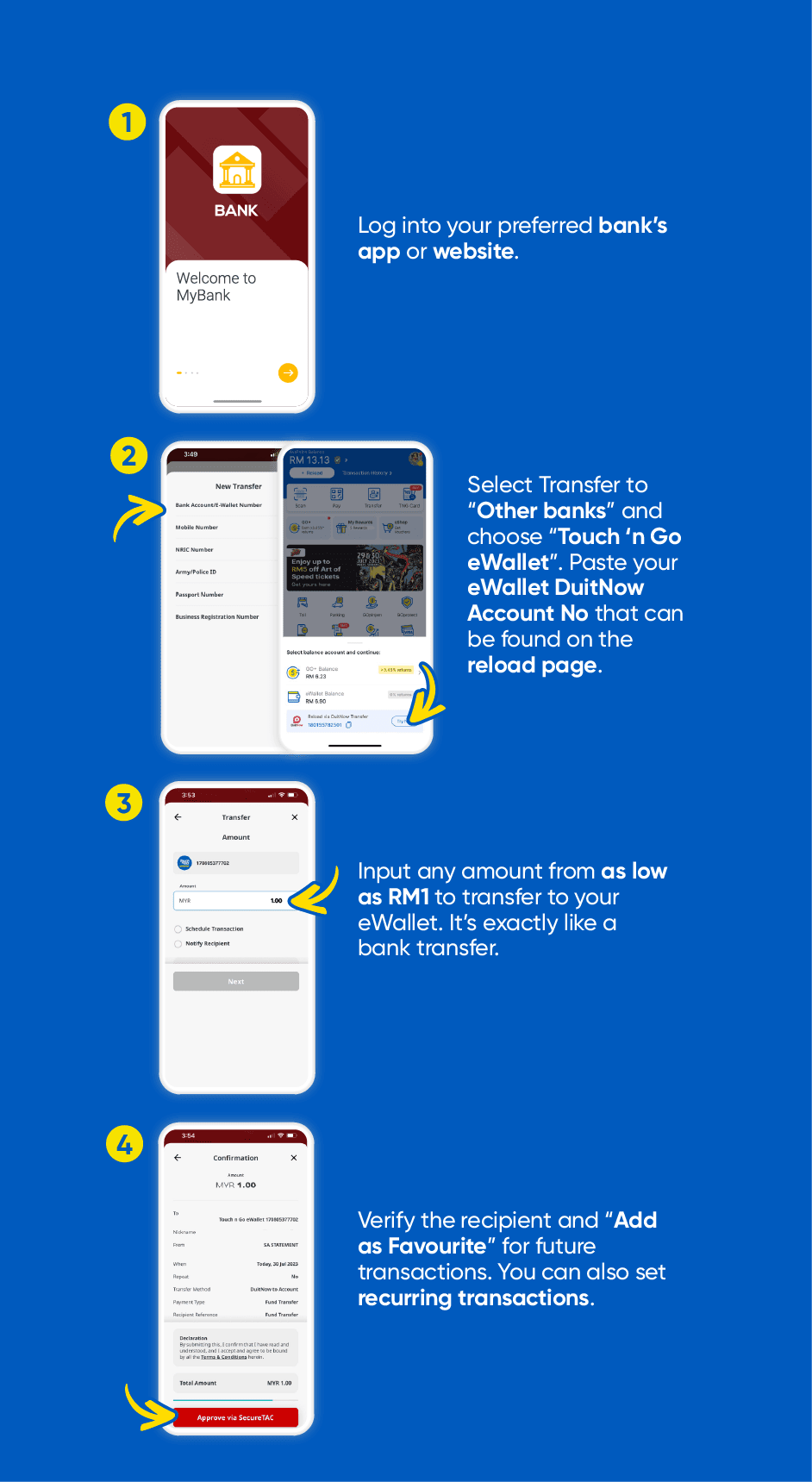

Touch ‘n Go eWallet Upgrades its Online Banking reload function from FPX to DuitNow Transfer

TNG Digital Sdn Bhd (“TNGD”) announced that it has upgraded all online banking reload functions via the Touch ‘n Go eWallet from FPX to DuitNow Transfer, effective 31 July 2023. This upgrade offers users a convenient and safer method to reload their eWallet directly from their bank apps or websites. DuitNow services provide more features that are convenient to users which include saving the Touch ‘n Go eWallet DuitNow Account Number as favourite in the bank app for future transactions and the option to set-up automatic reoccurring transactions. This service also allows eWallet reloads from as low as RM1, with no additional fees or charges. In addition, this upgrade to DuitNow services is an added security measure that provides peace of mind to users and significantly reduces the risk of potential information being leaked by third-party providers. For the first-time set up, users need to input their eWallet DuitNow Account Number in their bank app or website, choose their preferred relo...

- Get link

- X

- Other Apps

Touch 'n Go eWallet users can now enjoy seamless cross-border payments in more countries

Convenient transactions in local currency at popular destinations such as mainland China, Japan, Singapore, South Korea, Thailand, and Indonesia Touch 'n Go eWallet now offers its more than 20 million users a seamless payment experience in popular destinations such as mainland China, Japan, Singapore, South Korea, Thailand, and Indonesia. This development brings its users a vast network of millions of merchant touchpoints, enabled through its integration with national cross-border QR payment and its partnership with Ant Group’s Alipay+. For instance, Touch 'n Go eWallet is now accepted across Indonesia’s QRIS network, allowing its users to pay seamlessly with competitive exchange rates at more than 25 million merchant touchpoints. Since 2022, Touch 'n Go eWallet has been integrated with Alipay+, a suite of cross-border payment and marketing solutions, enabling cross-border payments for its users across Alipay+’s merchant network in Chinese mainland, Japan, South Korea, and ...

- Get link

- X

- Other Apps

Touch ‘n Go eWallet offers complete payment coverage for on-street parking in Kuala Lumpur and Selangor

First eWallet in Malaysia to offer complete coverage for on-street parking in both Kuala Lumpur & Selangor. Newly enabled councils include Majlis Perbandaran Klang, Majlis Bandaraya Seremban - Nilai, and Majlis Perbandaran Ampang Jaya Exciting prizes await users who pay for parking using the eWallet from 3 July to 4 August 2023 Touch ‘n Go eWallet users are now able to conveniently pay at more areas under the 19 enabled councils, with complete coverage for both Kuala Lumpur and Selangor areas. The newly enabled councils are the Majlis Perbandaran Klang, Majlis Bandaraya Seremban - Nilai, and Majlis Perbandaran Ampang Jaya. Alan Ni, Chief Executive Officer of TNG Digital Sdn Bhd said, “Touch ‘n Go eWallet is the first eWallet in Malaysia to offer complete coverage for on-street parking in both Kuala Lumpur and Selangor. With this, we are addressing pain points experienced by our users, especially with the removals of parking machines.” This expansion of the on-street parking feature...

- Get link

- X

- Other Apps

Pay with Touch ‘n Go eWallet on Taobao App

Users can now checkout their shopping cart on the Taobao App using the eWallet As part of ongoing efforts to drive further convenience and encourage cashless payments, TNG Digital Sdn Bhd (“TNG Digital”) announced that their users now have the option of using Touch ‘n Go eWallet on the Taobao App as a mode of payment for their shopping cart. This is enabled through Alipay+, the global cross-border digital payments and marketing solution operated by Ant Group. Alan Ni, Chief Executive Officer of TNG Digital said, “We see this as an added convenience for our users who shop for their favourite items on the Taobao App. They can rest assured that all transactions are done within a secured environment, and we encourage users to choose Touch ‘n Go eWallet for their mode of payment during checkouts.” In conjunction with the launch and the Taobao 6.18 Mid-Year Sale, there will be exciting promotional offers for users from 15 to 20 June 2023 when they pay for their Taobao purchases with Touch ‘n...

- Get link

- X

- Other Apps

Malaysians Can Truly Go Cashless in Singapore

The largest merchant network for a Malaysian eWallet in Singapore Touch ‘n Go eWallet announced recently that their users from Malaysia can now conveniently make cashless payments at even more participating merchants in Singapore. Since 2022, Touch ‘n Go eWallet users have been able to make payments for products and services at any Alipay+ merchants across Singapore. With the recently announced enablement via the DuitNow -NETS cross border partnership, Touch ‘n Go eWallet users can now scan and pay at any merchant displaying NETS QR via NETS payment terminals or SGQR, which include popular local kopitiams and hawkers that do not accept cards. With the above, the merchant network in Singapore accepting Touch ‘n Go eWallet has now grown to over 130,000 touchpoints, the widest cross border payment coverage for a Malaysian eWallet in Singapore. They will be able to conveniently transact in their own local currency with live foreign exchange rates, displayed in the Touch ‘n Go eWallet app ...

- Get link

- X

- Other Apps

Ramadan And Raya Made Merrier With Touch ‘n Go eWallet

Users can enjoy a variety of promotions, cashback, and rewards Touch ‘n Go eWallet has a variety of promotions and activities to celebrate Ramadan and Raya. All Touch ‘n Go eWallet users will enjoy more than RM2 million worth of exclusive rewards, ranging from iftar-related food deals and shopping promotions to balik kampung travel deals. Some of the promotions include: Firefly – up to RM30 cashback (20 March - 30 April) Easybook, KTMB, Redbus – Book your travel tickets and enjoy up to RM8 cashback (20 March – 30 April) Touch ‘n Go RFID tag – RM5 cashback (30 March – 16 May) Mydin – Up to RM5 randomised cashback (13 March – 7 May) 7 Eleven – Up to RM500 randomised cashback (17 April – 21 May) foodpanda – RM5 off with promo code TNG5 (23 March – 21 Apr) Kyochon 1991 – Get an RM10 cashback voucher for next purchase (15 March – 30 April) Burger King – RM1 for 5pcs Nuggets (1 – 30 April) Tealive – RM2 cashback (1 – 30 April) MyTukar – RM250 cashback (1 April – 31 May) Legoland – 25% off da...

- Get link

- X

- Other Apps

Touch ‘n Go eWallet Adds CI Insure and MotoInsure to its Latest Insurance Offerings

A total of 6 insurance products are now available for easy purchase through the eWallet app Touch ‘n Go Group, via TNG Digital Sdn Bhd (“TNG Digital”), owner and operator of Touch ‘n Go eWallet, has launched 2 new insurance products, CI Insure and MotoInsure on the eWallet. CI Insure is a health insurance, provided by AIA, which covers the top 5 critical illnesses in Malaysia, i.e. cancer, heart attack, stroke, kidney failure, and serious coronary artery disease. Users can get themselves an insurance plan at an affordable price of RM10* per month, with the sum insured ranging from RM30,000, RM50,000, and RM100,000. The plan offers a Lifestyle Assistance Allowance benefit which provides cash allowance up to RM5,000 per month for up to 3 months, on home nursing care, hospice care, palliative care, and home cleaning expenses to support day-to-day living upon diagnosis of the critical illness covered under the plan. In addition, users can obtain professional medical opinions and treatment ...

- Get link

- X

- Other Apps

Touch ‘n Go eWallet Successfully Implements 5 New Safety and Security Measures

The first and only eWallet in Malaysia to implement the mandatory measures imposed on banks Alan Ni, Chief Executive Officer of TNG Digital Sdn Bhd (centre) with Mohd Herman Sarbini, Chief Operating Officer of TNG Digital Sdn Bhd (right) and Foo Yeong Jin, Director of Data & Analytics, TNG Digital Sdn Bhd at the media briefing on the implementation of the 5 safety and security measures for Touch ‘n Go eWallet. Touch ‘n Go eWallet is pleased to announce that it has successfully implemented all 5 mandatory safety and security measures imposed by the Bank Negara Malaysia to combat scams, 4 months before the given deadline, and ahead of banks and other eWallets in Malaysia. “At Touch ‘n Go eWallet, our growing users are our largest asset. With the continuous rise of financial scams and security breaches involving eWallet and bank transactions, keeping our users’ online accounts safe and secure has become our primary concern,” said Alan Ni, Chief Executive Officer of TNG Digital Sd...

- Get link

- X

- Other Apps

Touch ‘n Go eWallet Expands Payment Reach to Asia’s Leading Delivery Platform, foodpanda

eWallet users get instant cash discount at checkout with a minimum spend of RM25 With contactless payments becoming more prevalent over the past few years, Touch ’n Go eWallet has expanded its payment reach to partner with foodpanda Malaysia, the country’s leading quick commerce delivery platform. This partnership creates a synergistic payment ecosystem which will enable Touch ‘n Go eWallet users to enjoy the convenience of foodpanda’s delivery services nationwide. From now till 28 February 2022, Touch ‘n Go eWallet users will also enjoy RM12 off when they spend a minimum of RM25 at checkout via Touch ‘n Go eWallet when placing orders on foodpanda. Commenting on the collaboration, Alan Ni, Chief Executive Officer of TNG Digital Sdn Bhd said, “Touch ‘n Go eWallet is excited to partner with foodpanda to provide more than 18 million Touch ‘n Go eWallet users access to a seamless delivery experience across Malaysia.” “Our users will be able to enjoy the convenience of foodpanda’s delivery...

- Get link

- X

- Other Apps

Touch ‘n Go eWallet Wins Platinum at Putra Brand Awards 2022

Recognised as the people’s choice in the e-commerce category Touch ‘n Go eWallet was awarded the Platinum award in the eCommerce category of the Putra Brand Awards 2022. Attending the awards ceremony from Touch ‘n Go eWallet were Chief Operating Officer, Mohd Herman Sarbini (2nd from left), Director of Marketing Communications and Sustainability, Izra Izzuddin (centre), Chief Commercial Officer, Danny Chua (3rd from right) and team members from their Marketing Communications Division. Touch ‘n Go eWallet was awarded the platinum award under the e-commerce category at the Putra Brand Awards 2022, in recognition of its image as a brand builder and preferred choice by consumers. Commenting on the award win, CEO of TNG Digital Sdn Bhd, Alan Ni said, “Being recognised as the people’s choice and receiving the top award in this category means a great deal for us as a brand that has more than 18 million users. “Over the years, we have put forward our best endeavours to address customers’ ne...

- Get link

- X

- Other Apps

Touch ‘n Go eWallet and Fave partner to offer cashback to eWallet users in Malaysia

Touch ‘n Go eWallet integrates with Fave to offer a brand new, convenient scan payment flow within the eWallet app that offers cashback rewards More than 18 million Touch ‘n Go eWallet users can earn cashback and The Goal Hunter stamps when scanning Fave DuitNow QR code at over 17,000 merchant locations in Malaysia Fave is offering additional rewards during the launch campaign period from 7 January until 31 March 2023. (L to R: Alan Ni, Chief Executive Officer of TNG Digital and Joel Neoh, Chief Executive Officer of Fave) Fave , Southeast Asia's smart payments app, has announced its partnership with TNG Digital Sdn Bhd (“TNG Digital”) owner and operator of Touch ‘n Go eWallet, and the launch of the Fave Loyalty Programme within Touch ‘n Go eWallet. Through the partnership with Fave, Touch ‘n Go eWallet users can now scan any Fave DuitNow QR, and earn up to 15 per cent cashback across 17,000 F&B outlets and retailers. Participating outlets include Subway, Auntie Anne’s, San Fran...

- Get link

- X

- Other Apps

Touch ‘n Go eWallet Announces Its Commitment To Fulfilling New Security and Fraud Prevention Measures

Currently, the first and only eWallet in Malaysia to fulfill the new measures imposed on banks by Bank Negara Malaysia As part of its ongoing efforts to enhance protection and security for its users’ accounts, Touch ‘n Go eWallet has committed to incorporating the five key measures which have been recently imposed on banks by Bank Negara Malaysia to combat financial scams. With the recent rise in serious security matters involving eWallet and bank transactions, the safety and security of their online accounts have become a primary concern amongst the general public when they use their eWallet and other digital channels to make purchases and transactions. Being a start-up and a non-bank provider, Touch ‘n Go eWallet has come forward to volunteer as the first and only eWallet in Malaysia to incorporate the new safety and security measures, ahead of the others. Touch ‘n Go eWallet will implement these five strategies by the first quarter of 2023: Enhance security by adding more authentic...

- Get link

- X

- Other Apps

Touch ‘n Go eWallet expands its cross-border payment capabilities to Mainland China

Touch ‘n Go eWallet is the first Malaysian e-wallet to be accepted for payments in Mainland China through its collaboration with Alipay+ Alan Ni, CEO of Touch ‘n Go Digital Sdn Bhd (right) with Angel Zhao, President of International Business, Ant Group. Touch ‘n Go Group, via TNG Digital Sdn Bhd (“TNG Digital”), owner and operator of Touch ‘n Go eWallet, recently announced the expansion of its cross-border payment capabilities to Mainland China. This capability was made available through its collaboration with Alipay+, a suite of global cross-border digital payments and marketing solutions operated by Ant Group. “We are pleased to continue our partnership with Alipay+ on cross-border payment solutions and expand our service territory beyond Singapore, Japan and South Korea. Touch ‘n Go eWallet is the first Malaysian eWallet which can be used for payments in Mainland China. This augurs well for all our users travelling there as they will enjoy the ease of making cashless payments, and i...

- Get link

- X

- Other Apps

Touch ‘n Go eWallet Announces Winners of Young Entrepreneurship Challenge 2022

The grand prize winners receive RM10,000 Touch ‘n Go eWallet credit and all the grand finalists get an opportunity to work with Malaysia’s No.1 eWallet company YEC 2022 Grand Prize Winner Touch ‘n Go eWallet recently announced the winners of their Young Entrepreneurship Challenge 2022 following the Grand Finals held at TNG Digital Sdn Bhd’s office in Bangsar South. The Young Entrepreneurship Challenge 2022 provides students with a platform to experience, innovate and foster their entrepreneurial skills within the eWallet industry. A total of 93 individuals and 88 teams, through a collective total of 256 presentation decks, shared their most innovative ideas on how Touch ‘n Go eWallet could continue to increase enjoyment while encouraging continuous usage of the eWallet among Malaysians. The objective of the challenge was to encourage students to showcase their inspirations for Touch ‘n Go eWallet as the go-to cashless payment of choice in Malaysia. 5 teams comprising a total of 18 stu...

- Get link

- X

- Other Apps

Touch ‘n Go eWallet and Maxis collaborate to provide seamless user experience

Users can effortlessly browse Maxis online store to pay bills, shop for Maxis products and services with exclusive offers and upgrade their mobile plans easily. Touch ‘n Go eWallet and Maxis recently announced that the two companies are collaborating to provide a smooth user experience for both Touch ‘n Go eWallet and Maxis customers. This collaboration allows Touch ‘n Go eWallet’s users to browse Maxis online store to pay bills, shop for Maxis’ products and services with exclusive offers and upgrade their mobile plans easily. With the surge in demand for contactless payments, and as payments are becoming increasingly cashless, the industry’s role in fostering digital inclusion has become a significant priority. “We are delighted to team up with Maxis. Touch ‘n Go eWallet and Maxis are brands that are rooted into Malaysians’ daily lives. We are happy to have a great partner to bring added value and create better experiences for users,” said Danny Chua, Chief Commercial Officer of TNG D...

- Get link

- X

- Other Apps